unemployment tax refund tracker

The state will ask you to enter the exact amount of your expected refund in whole dollars. The notice will include information on the refund you were eligible for the amount your tax refund was reduced by what agency the money was sent to and contact information for that agency.

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Read on to learn how IRS.

. To check the status of your refund go to My Alabama Taxes and then select Check my refund statusWheres My Refund located under Refunds. Currently only traditional state unemployment benefits are available to unemployed claimants. Fastest federal tax refund with e-file and direct deposit.

This is because the outstanding taxes you owe to the IRS always needs to be paid first. You can find this by signing in to TurboTax and scrolling down to Your tax returns documentsSelect 2021 then View adjusted gross income AGI in the right column. The Alabama Department of Revenue begins processing refunds starting March 1.

It is not your tax refund. While retroactive payments were made see sections below for several months following this date no new or further pandemic related benefits were paid. You can find this by signing in to.

Before any other federal or state agency can garnish your tax refund you must be current on your federal income tax payments. To check the status of your personal income tax refund youll need the following information. Your Social Security number SSN or Individual Taxpayer Identification Number ITIN Refund amount.

For example if you owe taxes for a prior year but expect a tax refund in the current year the federal government doesnt view this as an. Loans are offered in amounts of 250 500 750 1250 or 3500. The IRS issues more than 9 out of 10 refunds in less than 21 days.

Tax year of the refund. This is an optional tax refund-related loan from MetaBank NA. The PUA program ended on September 6 2021.

Typically the IRS will mail you out a notice if your tax refund is different from the amount you claimed on your tax return. The state will ask you to enter your adjusted gross income AGI. The refund date youll see doesnt include the.

Fastest Refund Possible. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Tax refund time frames will vary.

Pandemic Unemployment Assistance PUA program. To determine the status of your return you can use the IRS tax refund tracker which will also let you know if your return has been rejected by the IRS because of errors. You can track it at the Michigan Department of Treasury Wheres My Refund.

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

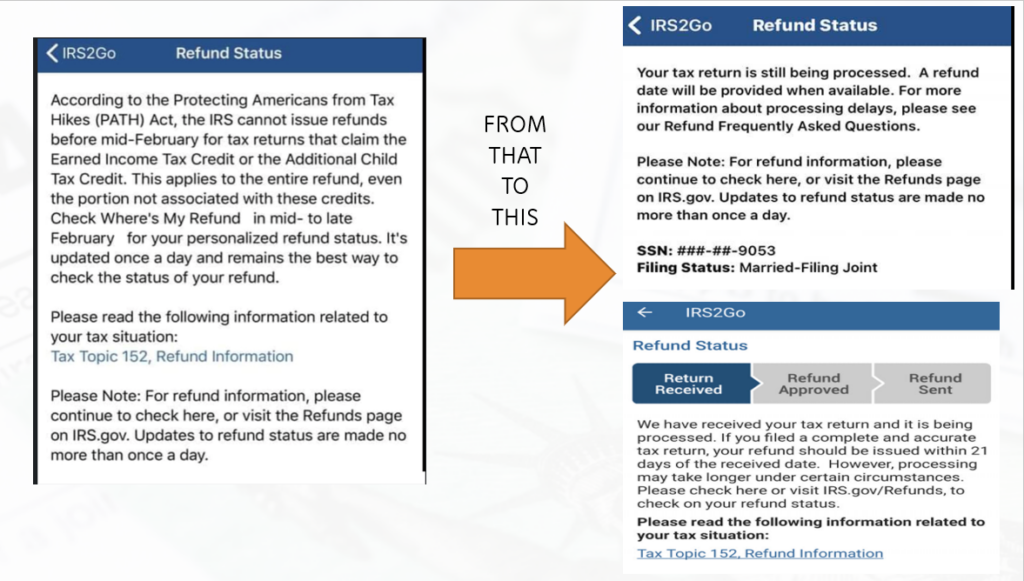

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

10 200 Unemployment Refund Check Status How To Check Your Unemployment Refund With The Irs Youtube

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Interesting Update On The Unemployment Refund R Irs

Tax Deadline 2021 Irs Tax Refund Status Where Is It And How Do You Track Your Money With Irs Tools Marca

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Irs Track My Refund Online 55 Off Www Wtashows Com

![]()

Tax Refund Tracker Where S My Refund Tax News Information

Tax Refund Status Is Still Being Processed

Tax Refund Offsets Where S My Refund Tax News Information

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Confused About Unemployment Tax Refund Question In Comments R Irs

Here S How To Track Your Unemployment Tax Refund From The Irs The Us Sun

Irs Refund Status Unemployment Refund Schedule Is Delayed Marca