how much is renters credit on taxes

A credit for taxpayers. With an adjusted gross income OR.

4 Things Landlords Should Know To Big Save At Tax Season Smartmove

Include advance rent in your rental income in the year you receive it regardless of the period covered or the method of accounting you use.

. Your California income was. A big tax credit was introduced for renters in Budget 2023 which will allow tenants squeezed by the housing crisis to claim as much as 1000. For questions about filing a renter credit claim contact us at.

The 500 per year relief has been. This included rent paid for flats apartments or houses. For example you sign a 10-year lease to rent your property.

In the first year you receive 5000 for the first years rent and 5000 as rent for the last year of the lease. You paid rent in California for at least 12 the year. The renters property tax refund program sometimes called the renters credit is a state-paid refund that provides tax relief to renters whose rent and implicit property taxes are high.

In California renters who make less than a certain amount currently 41641 for single filers and 83282 for married filers may be eligible for a tax credit of 60 or 120. To qualify for the rebate in 2022 you or your spouse must be over 65 years of age. It did not include rent.

You sign a 10-year lease to rent. To see if youre eligible first find your gross household. See CRP Information for Landlords for more information.

Mail the completed form to. Taxpayers who are over the age of 60 or 100. In Maryland for example taxpayers must meet a minimum rent-to-income ratio to be eligible for a deduction.

The average national cost for renters insurance is 125 per year for 15000 of personal property coverage. Threshold claimed that the Governments 500 annual tax credit for renters is only enough to cover seven days worth of rent in the average Dublin rental property. 15 2022 and you can file online.

For assistance calculating the alternate credit refer to worksheet 4 Alternate Property Tax Credit for Renters Age 65 and Older in the MI-1040 Individual Income Tax. Where there is an. Aged 65 or older OR retired on permanent and total disability and received taxable disability income for the tax year.

Vermont Department of Taxes. Colorado offers a PTC Property TaxRentHeat Credit rebate of up to 976 for eligible renters. Renters Tax Credit Applications for 2022 will be available for Maryland tenants on Feb.

43533 or less if your filing status is single or marriedregistered. If you cannot get a CRP from your landlord you can request a Rent Paid Affidavit RPA to apply for the Renters Property Tax Refund. This works out to a little more than 10 per month.

If the portion of rent attributable to the assumed property taxes exceeds a fixed amount in relation to income the renter can under specified conditions receive a credit of as. Up to 31 December 2017 you could claim a tax credit if you paid for private rented accommodation. The tax year 2019 requirements per Line 29 Credit for Low-Income Household Renters in the 2019 N-11 Hawaii Resident Income Tax Instructions are.

The property was not tax exempt.

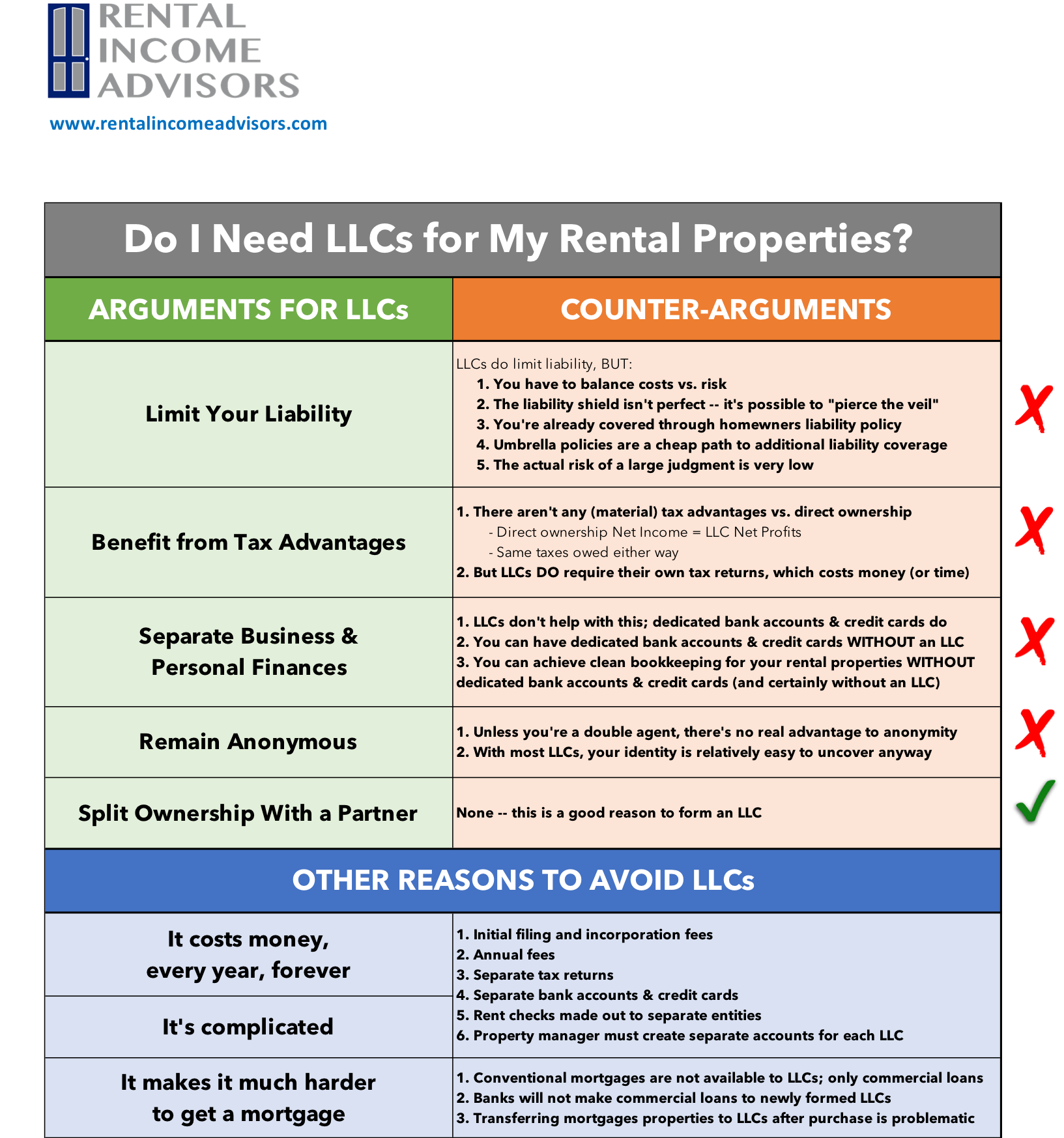

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Analyzing A Renters Credit Score Stone Browning

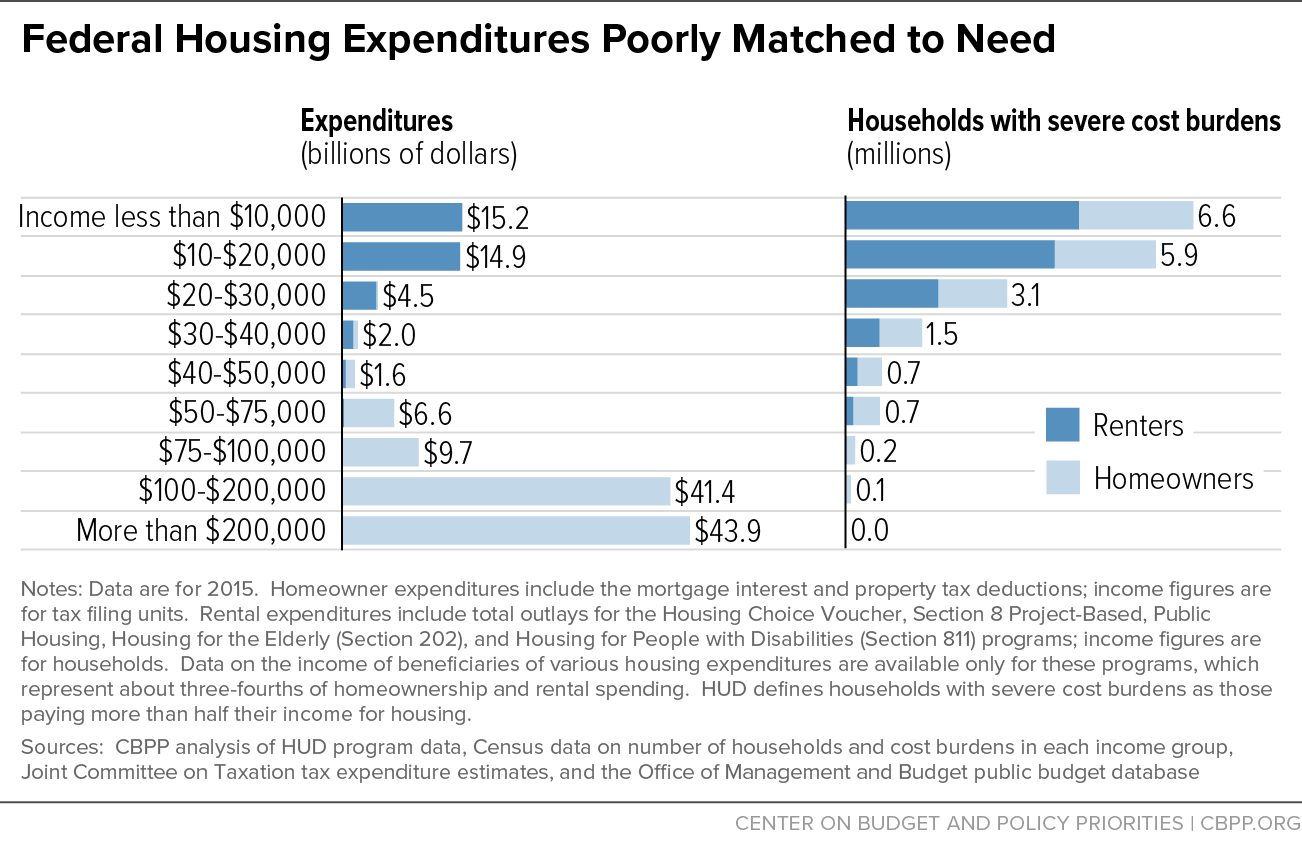

Renters Credit Would Help Low Wage Workers Seniors And People With Disabilities Afford Housing Center On Budget And Policy Priorities

Nj Renters In Line For Some Needed Tax Relief Nj Spotlight News

Landlord Certificates Department Of Taxes

New Jersey Governor Floats Property Tax Relief For Homeowners Renters

Low Income Housing Tax Credit Could Do More To Expand Opportunity For Poor Families Center On Budget And Policy Priorities

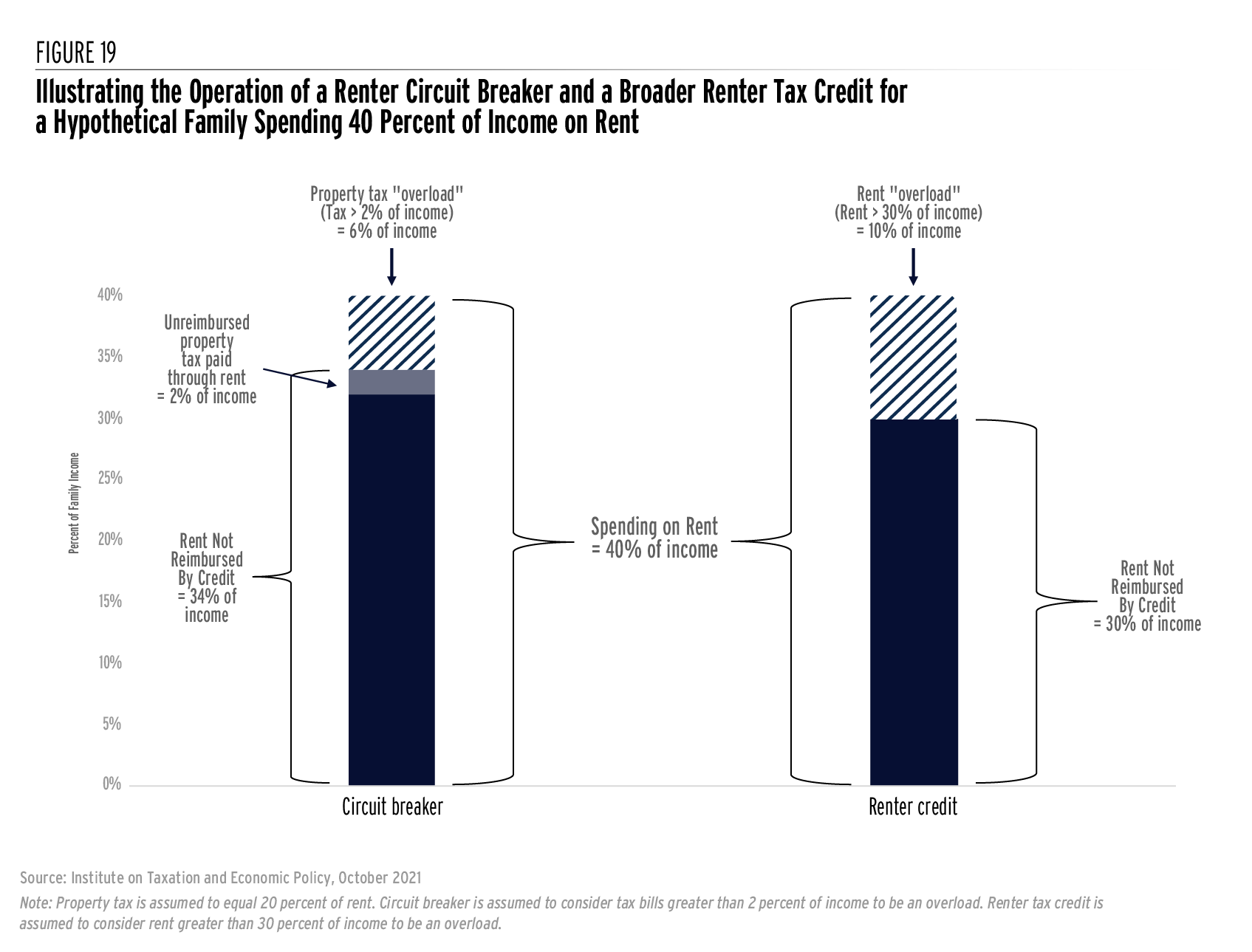

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Three Tax Deductions For Renters Irvine Company Apartments

Can You Get A Tax Credit For Paying Rent

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Missouri Department Of Revenue The Missouri Property Tax Credit Allows A Maximum Credit Of 750 For Renters And 1 100 For Owners Who Owned And Occupied Their Home Note If You Rent

Pa Property Tax Rent Rebate Apply By 12 31 2022 New 1 Time Bonus Rebate Announced 8 2 2022 Legal Aid Of Southeastern Pennsylvania

Taxes Kansas Action For Children

California Bill Would Boost Renter Tax Credit For First Time In 40 Years Kqed

Renter Credit Department Of Taxes

Rental Real Estate And Taxes Turbotax Tax Tips Videos